In the past three months, the import of passenger car, light truck, and bus tires into the U.S. has seen fluctuations. However, the overall trend for the first three quarters of 2024 indicates an increase in these tire imports. This article delves into the latest import data and highlights critical trends affecting the Chinese tires industry.

Passenger Car Tire Imports

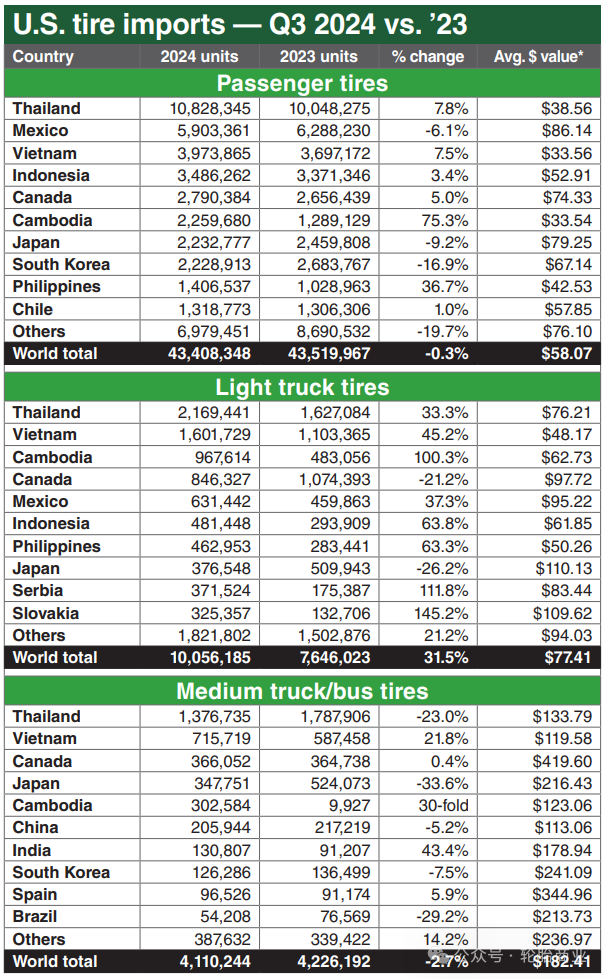

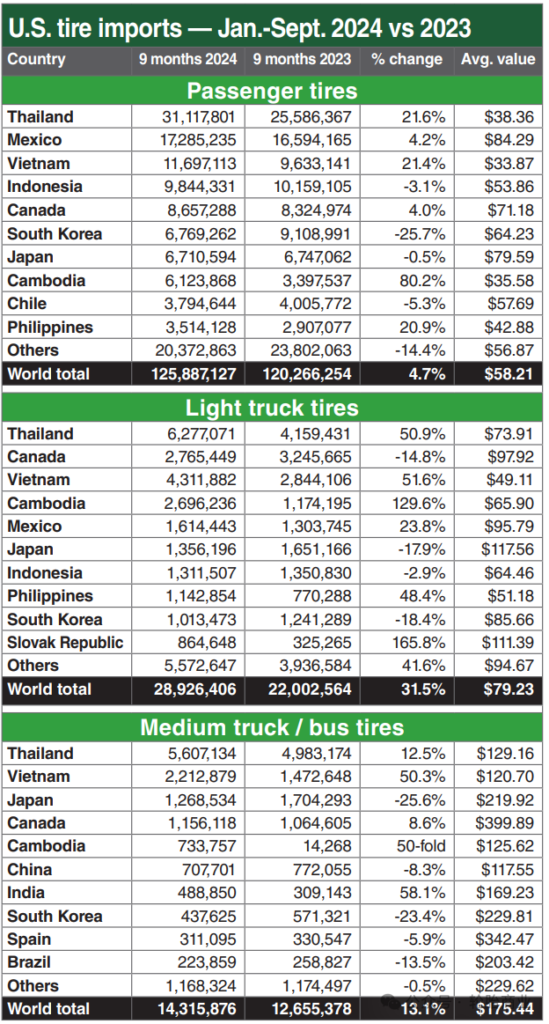

In the third quarter of 2024, Thailand emerged as the leading exporter of passenger car tires to the U.S., with imports reaching 10,828,345 units—an increase of 7.8% compared to the previous year. For the first three quarters, the total passenger car tires imported from Thailand amounted to 31,117,801 units, reflecting a significant year-over-year growth of 21.6%. Other key suppliers include Mexico and Vietnam, while many Chinese tire manufacturers have strategically relocated their operations to these countries to maintain competitiveness.

Light Truck Tire Imports

Light truck tire imports into the U.S. remain robust, with a total of 28,926,406 units imported, marking a remarkable 31.5% increase from the previous year. Thailand continues to dominate this market, with an impressive growth of 50.9% in exports to the U.S. Chinese light truck tires have notably fallen off the radar, with Canada and Vietnam now taking the second and third spots, respectively.

Bus and Truck Tire Imports

Thai manufacturers still lead in exporting bus and truck tires to the U.S. Several Chinese tire companies, such as Zhongce Rubber, Linglong, and Double Coin, have established factories in Thailand, contributing to their profitability in this market.

China's Diminishing Influence in the U.S. Tire Market

The decline of Chinese tires in the U.S. market can be traced back to significant trade barriers. On June 29, 2009, the U.S. International Trade Commission proposed imposing steep tariffs on Chinese imports of passenger and light truck tires, leading to a three-year tariff plan initiated by President Obama. This created a formidable trade barrier that has lasted over a decade, culminating in the infamous tire safeguard case.

In 2018, the trade war escalated under President Trump’s administration, imposing a 25% tariff on a vast majority of Chinese imports, which severely impacted the tire industry. The ongoing trade tensions have pushed many Chinese manufacturers to the brink, struggling to maintain their foothold in the U.S. market.

The Future of Chinese Tires in the U.S. Market

With Trump’s recent reelection, the threat of heightened tariffs looms larger than ever. His administration’s intention to impose further aggressive tariffs could destabilize not just the Chinese tire industry but also the global tire trade ecosystem. The U.S. Department of Commerce recently announced anti-dumping duties of 12.33% to 48.39% on truck tires imported from Thailand, which could disrupt the trade routes previously utilized by Chinese manufacturers.

Additionally, Chinese tire companies have invested heavily in factories in Mexico as a strategic move to circumvent U.S. tariffs. However, with Mexico’s increasingly aligned trade stance with the U.S., this route may soon become untenable.

Global Trade Challenges

The challenges extend beyond the U.S. border, as Chinese tires face anti-dumping investigations from multiple countries, including Brazil, South Africa, and members of the European Union. This global trade war is intensifying, isolating Chinese tire manufacturers and threatening their survival in an increasingly hostile market landscape.

In summary, the Chinese tire industry is navigating a complex and challenging environment, marked by rising tariffs, strategic shifts, and global scrutiny. The future remains uncertain as manufacturers adapt to these evolving market dynamics.